What happens when a stock priced for growth stops growing? It tanks. And

what happens when a stock priced for growth reverses trend and starts recording

fall in revenues? It gets pummeled. Take a look at Restaurant Group Plc (RTN:LSE), the UK

based restaurant operator with over 500 establishments and with principal trading

brands including Frankie &

Benny's, Chiquito and Coast to Coast. Its stock has lost over 51% of its value

since the high of £7.24 in November 2015, wiping out £747m from its market cap

in the process. It currently trades at £3.52, this after having fallen to £2.72

recently. The recent uptick is mostly on the back of rumors that a

private-equity backed takeover may be coming.

I want to

take a look at whether this fall offers a value opportunity. Has the market

overreacted? Could the fall in sales simply be a hiccup, with no structural or

fundamental reasons, offering a great opportunity to buy and wait for mean

reversion? Let’s investigate.

First some

key facts on the company. In the below table I look at cheapness (EV/EBIT)

& quality (ROIC). I have also shown these ratios for before the fall in the

stock (i.e., Nov15).

As

can be seen from the table above, the company’s EV/EBIT ratio has fallen from a

high of 17.24x in Nov15 to 10.55x today. If one back’s out market’s implied

growth & ROIC estimate for this fall, assuming a cost of capital of 8% and

a tax rate of 15%, then this implies that the market has wiped out all or most

of its growth & ROIC expectation from the stock. For example, the 17.24x

multiple would imply that the market had priced the stock for a ~5% growth with

a ~13.25% ROIC; and at 10.55x multiple, growth would be almost non-existent,

with a fall in ROIC to ~10%. Note that my assumption of 8% cost of capital and

15% tax rate is based on my calculation of the company’s WACC and effective tax

rate, and for completeness, I calculate my implied growth & ROIC percentages

using the following formula for the multiple.

From ~5% implied growth and 13.25% ROIC to ~0% growth and >300bps fall in ROIC, has the market overreacted? Does one trading update from a company signalling poor trading conditions and a potential 2.5% to 5% fall in like for like sales merit such a pummeling?

This company

has grown sales at a CAGR of over 7% over the last 5 years (FY11 – FY15); is

extremely cash generative with a free cash flow from operations yielding ~9%;

and it has a dividend yield of ~5%. Surely it is a buy, and it is only

a question of waiting for mean reversion to take its natural course and revenue

growth will come back, giving a handsome return for the value buyer? Not so

fast.

I dug up the last 5 year

financials to piece together the pattern in sales growth, knowing that the

company’s 7% CAGR growth in revenue has come from both like-for-like sales

growth, and from new store openings. Take a look at the table below.

As the table above shows, LFL revenue growth has been falling, and was at its lowest level over the last 5 years in FY15, just a 1.5% LFL revenue growth. In particular, over the last 3 years, majority of the growth in sales have been coming from new restaurant openings, with 81% of the growth in sales for FY15 coming from new openings. This is at the heart of the challenges facing the company. Growing revenues by opening new restaurants is fine as long as your ROIC is greater than your cost of capital (which seems to be the case for the company at present, and as long as it stays that way, it should go on opening new restaurants); but LFL revenue growth is the better indicator of the company’s long term health. If LFL sales are faltering, then it is only a matter of time before it starts biting into new openings and on ROIC. So what’s the story here? The answer in one word – competition.

Michael

Porter in his classic 1980 book - Competitive

Strategy - described that the intensity of competition in an industry is determined by five

forces: threat of new entry, pressure from substitute products, bargaining

power of buyers, bargaining power of suppliers, and the degree of rivalry among

existing competitors. As this recent FT

article nicely sums up, UK restaurants are having to fight multiple battles

at the same time:

with new entrants in the traditional eating out space (rivalry among existing & new competitors is intense); new rivals offering the online/delivery options are thriving and gaining ground (substitute products); more people are choosing the option of ordering at home more often and even when they eat out they have plenty more options to choose from (bargaining power of buyers); all of this makes the cost of leasing out space in the best locations more expensive (bargaining power of suppliers). Data from Euromonitor show that growth in home delivery and takeaway food has outpaced that of restaurants each year since the financial crisis. Between 2009 and 2014, the UK market for take away and delivery expanded 2.7 per cent to £6.5bn, while the value of food bought in restaurants fell 5 per cent to £17.1bn. Restaurant Group is heavily exposed to this trend as it does not deliver, and hardly has an online presence which could compete with rivals. In addition to the intense competition, the increase in national minimum wages from this year is going to eat into margins further (for Restaurant Group this will add at least £2m to its cost base this year).

with new entrants in the traditional eating out space (rivalry among existing & new competitors is intense); new rivals offering the online/delivery options are thriving and gaining ground (substitute products); more people are choosing the option of ordering at home more often and even when they eat out they have plenty more options to choose from (bargaining power of buyers); all of this makes the cost of leasing out space in the best locations more expensive (bargaining power of suppliers). Data from Euromonitor show that growth in home delivery and takeaway food has outpaced that of restaurants each year since the financial crisis. Between 2009 and 2014, the UK market for take away and delivery expanded 2.7 per cent to £6.5bn, while the value of food bought in restaurants fell 5 per cent to £17.1bn. Restaurant Group is heavily exposed to this trend as it does not deliver, and hardly has an online presence which could compete with rivals. In addition to the intense competition, the increase in national minimum wages from this year is going to eat into margins further (for Restaurant Group this will add at least £2m to its cost base this year).

If an entire sector is in distress, then distressed companies within that

sector could be good bets – as the sector recovers, those companies could

bring great returns. But if a sector is thriving overall – overall revenues for the consumer/retail food sector is growing and people are spending more on food – and there are pockets of distress due

to rapid changes in the industry, then it calls for caution when inspecting

distressed stocks in that sector. There could well be a valid reason for the distress.

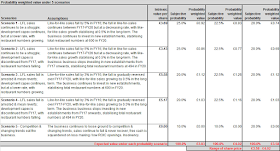

Given the intensity of competition in the sector, and the difficult / uncertain trading conditions faced by Restaurant Group, the approach to determining its intrinsic value needs to take account of the many possible outcomes. I have used a scenario based approach, with intrinsic value being the expected payoff taking account of the various outcomes. I have analysed intrinsic value under 5 scenarios which combine various assumptions for revenue growth & decline and for development capex (determined by the number of new openings or closures). My analysis concludes that

the intrinsic value per share for Restaurant Group Plc is in the range of £3.5 - £4. Given the current share price of £3.52, I don't believe that the stock offers adequate margin of safety for a value investor.

You can see a table with my summary of probability weighted intrinsic value, including

detailed DCF calculations for each scenario, in the tables at the end the end of this write-up. My sources and reference material have mostly been the company’s last 5 years financial statements (FY11

– FY15).

Finally, my

thoughts on the recent news of a private equity takeover of the group. Any

takeover of a public company would have to be at a premium of at least 20% -

30% to current the share price, giving a target price of at least £4.23 to £4.58 a

share based on closing share price of £3.52 on 20 May 2016. Given that a

private equity buyer will have a return (IRR) expectation of at least in the

mid-teens, I find it difficult to see that level of return for at current price. I am not ruling a bid out, or the fact that a buyer with an edge and detailed knowledge of the portfolio on a restaurant by restaurant basis may well know how to generate that return. But any buyer will need to get their hands very dirty with the operational aspects and I suspect will also need to place a lot of faith in growth reverting.

This stock could yet be a value buy. There could well be a sell-off - e.g. if market's recent expectations of a private equity buyout in

the near future does not materialize. Secondly, it is worth watching closely the outcome of the strategic review being carried out by the management, the results of which are to be announced in August. This situation merits monitoring on an ongoing basis.

Probability weighted intrinsic value per share under various scenarios

DCF valuation for Scenario 1 - LFL sales continues to be a struggle; development capex continues, but at a lower rate, with restaurant numbers growing.

DCF valuation for Scenario 2 - LFL sales continues to be a struggle; development capex is discontinued from FY17, with restaurant numbers falling.

DCF valuation for Scenario 3 - LFL sales fall is arrested & mean reverts; development capex continues, but at a lower rate, with restaurant numbers growing.

DCF valuation for Scenario 4 - LFL sales fall is arrested & mean reverts; development capex is discontinued from FY17, with restaurant numbers falling.

In your view, is there now a MOS @ 260p?

ReplyDeleteUnfortunately, post Brexit, all bets are off. Even without Brexit, they were facing severe headwinds due to competition; the last thing they would have wanted is a risk of a UK recession - which looks more likely post Brexit. I would wait and watch for the next few quarters, more profit warnings are coming down the line I suspect. It is a matter of weighing the probability of a severe recession which is far from a certainty.

ReplyDelete